It is commonly believed that the only things certain in life are death and taxes.

And despite the criticism faced by the extremely affluent for not contributing their fair portion, there's one domain where evading the taxman is quite challenging: real estate.

And despite the criticism faced by the extremely affluent for not contributing their fair portion, there's one domain where evading the taxman is quite challenging: real estate.

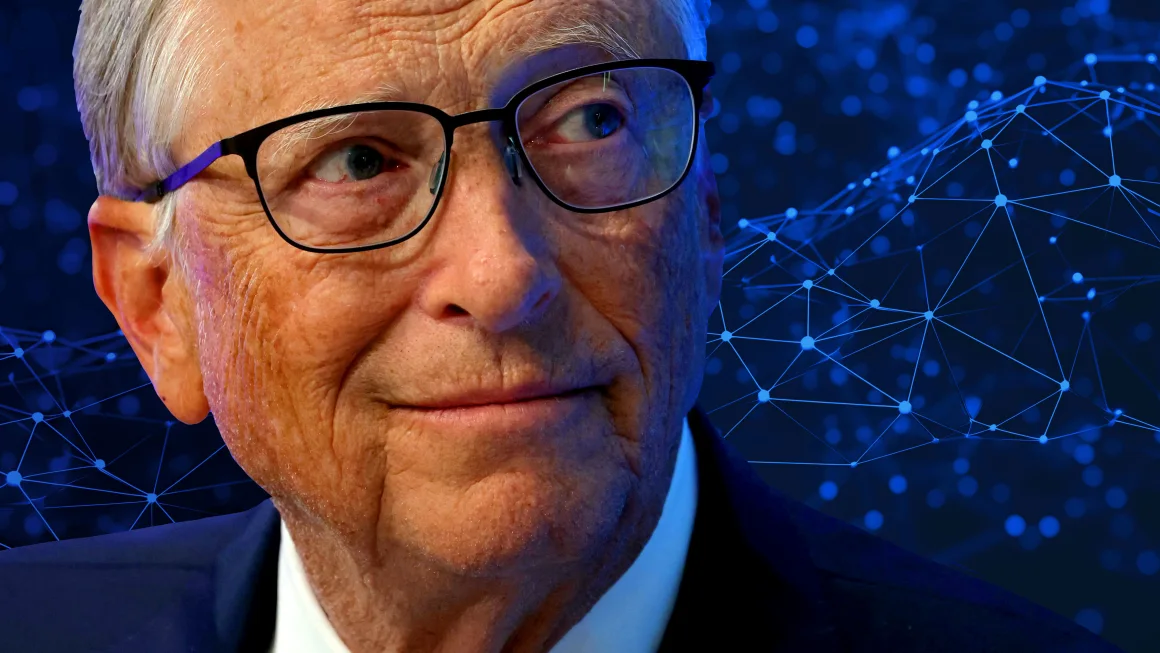

Bill Gates is among them. In the previous year, Gates and his ex-wife, Melinda French Gates, accumulated a property tax bill of $2.7 million. This amount surpasses what the average American pays in property taxes by over 700 times.

Bill Gates, the ex-wealthiest individual globally, has acquired a staggering 275,000 acres of land, positioning him as the 42nd largest landowner in the United States, as reported by the Land Report. Although the majority of his land holdings are dedicated to agricultural purposes and investments, he reserves 245 acres for his personal use.

They have invested over $150 million in the past thirty years to acquire their present real estate collection. After their divorce in 2021, several properties were transferred between trusts. Identifying the true owners is extremely challenging since all their trusts are associated with the same Seattle bank.

Bill Gates faces his highest property tax bill in Washington state, owning a 10.5-acre property in the upscale Seattle suburb of Medina by Lake Washington. He acquired 12 parcels surrounding his mansion, Xanadu 2.0, for $34 million, with a combined assessed value of $183.5 million. Last year, the total property taxes amounted to $1.3 million. This year, the taxes on the largest parcel, 5.15 acres by the water, will surpass $1 million.

Gates possesses five estates in California, renowned for their exorbitant property values. The Del Mar beach house, acquired by him in 2020 for a staggering $43 million, holds the distinction of incurring the highest taxes. Last year, this remarkable abode commanded a tax payment of approximately $480,000.

Gates paid $280,000 in taxes last year for his equestrian compound in Wellington, Florida, and $107,000 for his house in the exclusive Yellowstone Club in Montana.

Despite being considered high by most standards, Gates' property tax bill accounts for less than 0.01% of his $148 billion net worth, and only a fraction of his overall tax obligations.

Bill Gates has a higher effective tax rate on his wealth growth compared to other billionaires, but a lower effective tax rate on his income than most other billionaires and high-earning Americans. In 2022, ProPublica revealed that his average annual income from 2013 to 2018 was $2.85 billion, with an annual federal income tax rate of 18.4% — indicating he would have paid around $525 million in federal income tax each year, as per BI calculations.

He doesn't usually complain. Gates has mentioned that the extremely wealthy should contribute more in taxes.

“In terms of the very rich, I think they should pay a lot more in taxes, and they should give away their wealth over time,” he said during a Reddit “Ask Me Anything” last year.